Pros & Cons of Semi-Monthly Pay – Explained

Semi-monthly pay is a payment plan where you are paid every other week. Hence. two times every month, you’d get compensated for your efforts.

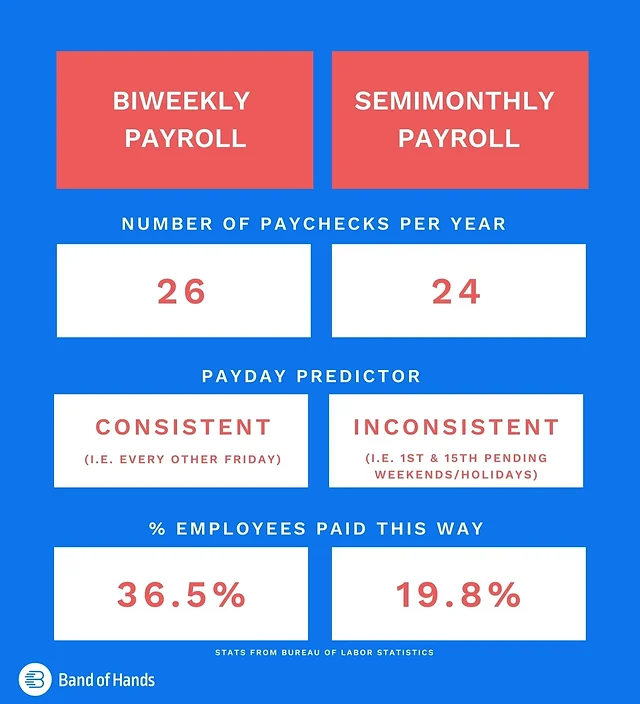

The “US Bureau of Labor Statistics” reports that, behind the weekly and biweekly pay periods, the semi-monthly salary cycle are most popular pay week in the United States.

The Pros of Semi-Monthly Payment Stages

Following are the pros of semi-payment payment periods;

1.Semi-monthly Payment Durations Helping Businesses Saving Money

Semi-monthly payments help businesses conserve money in many ways. Half-monthly pay periods are more economical for businesses. Because there are fewer pay periods of time, administration and wage costs are much lower than to a Weekly payment schedule.

A weekly wage schedule has 52 pay periods, whereas a semi-monthly pay period has just 24. This results in fewer pay periods each year for workers.

2. Enhances Efficiency

The productivity is raised when staffs are paid every binary weeks. In comparison to workers who get a lesser weekly compensation, those who receive a substantial payout on a regular basis may be more productive.

3. Match the Business Cycle More Accurately

The rhythms of business are more closely aligned with semimonthly pay periods. Businesses may more easily meet their payroll obligations because employee payments coincide with cash flow.

4. Workers Get a Regular Paycheck

Employees who opt for the Semi-Monthly Pay plan may count on being paid twice a month, on the same day of the month. Hence, this makes budgeting less of a mystery and more accessible. However, which is great news for workers who need to prove their income using pay stubs. Because the semi-monthly pay dates are standard, there is no misunderstanding.

5. Lessen the Time Spent in Line

Semi-monthly pay periods happen on the first and fifteenth of each month. With semi-monthly pay, workers get their paychecks every two weeks instead of once.

6. Easy to figure out

Workers and managers alike will find the calculation of a semi-monthly pay period to be straightforward. Moreover, semimonthly occurs on a regular basis. Hence, the schedule streamlines payroll by removing two of its most problematic aspects: keeping up with unpaid wages’ buildup and handling unusual dates.

The Cons of Semi-Monthly Payments Stages

Below are provided the cons of semi-monthly payment stages, let’s explore them together.

1. Semimonthly salary periods are more challenging to budget for

Semi-monthly paychecks are more challenging for workers to plan around financially. Many workers whose wages are distributed on a weekly basis plan their spending around the regularity of their paychecks. Employees may have difficulty interpreting their bank statements and pay slips as a result.

2. It’s possible to incorrectly anticipate bimonthly pay periods

Employees may inadvertently exaggerate their compensation when paid semi-monthly. Some workers may have the misconception that their salary would start accruing on the date of their next paycheck if they are paid bimonthly. Because of this, workers may plan their finances around an incorrect amount.

3. Managers finding difficulty working with bimonthly pay periods

Managers may find it difficult to work with bimonthly pay periods. Pay periods that occur every two months might be confusing for managers. Budgeting on a semi-monthly payment cycle might be challenging for managers who aren’t used to it.

Conclusion

Before switching to a bimonthly pay cycle, businesses should learn everything they can and conduct their research. It’s possible that not all businesses would benefit from semi-monthly pay schedules. Despite the fact that a monthly salary is the most popular, semi-monthly pay is also frequent. Companies with over 20 workers benefit most from semi-monthly pay cycles.

For cost-effectiveness reasons, a semi-monthly system can only be used by companies with more than 20 workers. Semi-monthly pay periods may be inconvenient and laborious for a small firm. Not all workers are best served by being paid every other month. For instance, it might be challenging for a worker to wait until the last day of the pay month to get paid.

Any choice must take into account the company’s size and typical revenue. It is important to consider the methods of payment and personal tastes of all workers when deciding on a pay schedule.

In this approach, rules may be crafted to accommodate workers’ preferences for either the semi-monthly or weekly pay periods. than sum up, the bimonthly pay period is preferable than the alternatives. It’s the ideal compromise between the shorter weekly pay term and the longer monthly pay term. It meant being paid more often than once per month but more frequently than once per week.

The Most Commonly Asked Questions about Semi Monthly Pay

How often is semi-monthly?

Twice a month is a semi-monthly frequency.

Once every two months?

Semi-monthly is a payment frequency that however, occurs twice a month and is often used to describe salary.

Paid every other month: What does it mean?

Payments made semi-monthly occur every other month.

How often does it occur?

Once every two months (often at the month’s conclusion) is the definition of semi-monthly pay.

How do you figure out semi-monthly make a payment?

Two times each month are paid semi-monthly. Calculate the pay for a single month at half the set rate. For instance, if your monthly salary is $3,000, you would receive $1,500 twice every month, or semi-monthly.

What does it mean to get paid bimonthly?

An ongoing payment plan that occurs twice per month, often on the first and fifteenth of the month.

Semi-monthly occurs how often?

It is paid twice per month on various days throughout the month.

What does semi-monthly mean?

Two times each month is semi-monthly.

How many pay periods in semi-monthly?

Semi-monthly has two payments per month, i.e., paid twice a month on different days of the month with no interim pay periods included between them. For example, On the 1st and 15th of every month you will get your salary or your income tax return, so it is called semimonthly schedule.

In a semi-monthly payment term, how many installments/payments are there?

When paid semi-monthly, there are two installments made each month, which are made on separate days throughout the month without any intermediate payments in them. It is termed a semimonthly timetable, for instance, if you receive your pay or tax refund on the first and fifteenth of the month.

What number of semi-monthly checks are there in an entire year?

Each year, there are a total of 24 semi-monthly payment periods.

What could “semi-monthly” refer to?

Twice a month is considered semi-monthly.